I discussed previously how managing several social media accounts can be a challenge, pointing to the usefulness of social media aggregation tools. Many people, including myself, also have several financial accounts with different institutions (credit card with one bank, savings account with another, TFSA with another, etc.). Losing track of social media updates can be annoying, but losing track of your finances is obviously a much more serious problem.

It turns out that the same solution might work to solve both problems, namely using a tool to aggregate information from all your different accounts into a single location.

BILL MANAGEMENT

I switched from paper statements to electronic statements a long time ago. That has proven to be a big help as far managing my finances (and stress level). Since I check my personal e-mail several times a day anyway, when a bill shows up in my inbox, I notice it immediately. I hate paper mail, so I usually have to force myself to deal with it.

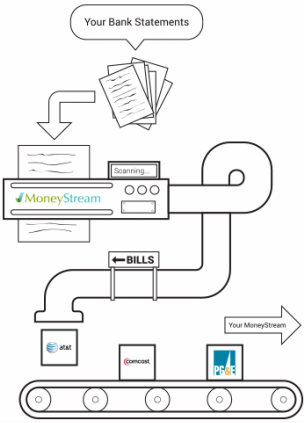

MoneyStream.com allows you to go further when it comes to managing your bills. Instead of relying on e-mail, it analyzes the transaction history of one or more of your bank accounts and/or credit cards and detects your bills, apparently using this machine shown on their site:

Then it puts all your bill information in a calendar, helping you keep track of when to pay what to who. It also helps you analyze your spending over time, making managing your budget much easier (in theory). It looks very cool, but for now at least, it is only available to Americans (or at least people who use American banks).

COMPLETE AGGREGATION… AND OBSTACLES

Mint is a another interesting and popular site (and app). It is a financial aggregation tool that lets you monitor all of your personal finances from the same place. They have a nice demo video. Using Mint means no longer having to log into several different accounts to check how much money you have and/or owe, instead you see it all together. In addition, it automatically analyzes your information (probably also using a machine like the one shown above), helping you to budget, set financial goals and track your progress. In short, it does everything you could hope a financial aggregation tool could do.

Unfortunately, using tools like Mint and MoneyStream are frowned upon (to put it lightly) by banks, at least in Canada. These sites try to make your life easier by automatically fetching information from your different accounts, since the alternative would be to force you to enter all of your constantly changing information manually. But to do that, they require your login information. Your cardholder agreements specify very clearly that you are not to give your login information to anyone, ever, for any reason. Hence the problem.

Some banks are trying to provide an alternative to using a third-party service. For example, RBC offers myFinanceTracker and BMO offers MoneyLogic. The concept is similar in that these tools help you track your spending, set goals and more, but of course, they only aggregate the accounts you have with them. If you are unfailingly loyal to one institution, then this is probably all you need. If you’re like me though, this doesn’t really help.

CONCLUSION

Personally, Mint is exactly what I was looking for and I would love to use it, but I am not willing to risk liability problems. There is hope that they will eventually be able to sign some kind of agreement with the different institutions I bank with, but until then, looks like I’m stuck with my spreadsheets.

Leave a Reply